In the Indian banking system, a crucial element facilitates smooth and secure transactions: the Indian Financial System Code (IFSC). We will explore how IFSC codes serve as unique identifiers for bank branches across India, making them vital for online banking transactions.

Knowing your IFSC code streamlines your banking experience, ensuring that funds reach the intended recipient’s account securely. This comprehensive guide will walk you through finding your IFSC code, understanding its structure, and using it effectively for various banking transactions, including credit and savings payments at your branch bank.

We will cover everything from basic definitions to practical tips for using IFSC codes effectively, emphasizing the security aspect and convenience they offer in making payments.

Key Takeaways

- Understand the importance of IFSC codes in the Indian banking system.

- Learn how to find your IFSC code quickly and conveniently.

- Discover the structure and significance of IFSC codes in online banking transactions.

- Explore practical tips for using IFSC codes effectively.

- Emphasize the security benefits of using IFSC codes for transactions.

What is a Bank IFSC Code?

IFSC codes are unique identifiers assigned to bank branches across India, facilitating electronic fund transfers. The Indian Financial System Code (IFSC) is an 11-character alphanumeric code that identifies individual bank branches participating in online money transfer systems. To find IFSC codes for your bank in India, you can easily check online resources, which are crucial for ensuring secure credit transactions. The Reserve Bank of India oversees these codes, making them essential for effective banking operations from the comfort of your home.

Definition and Purpose of Bank IFSC

The IFSC code is a crucial element in the banking system, enabling the transfer of funds between banks. It is used for various online money transfer options like NEFT, RTGS, and IMPS. The primary purpose of the IFSC code is to ensure that the funds reach the correct destination by verifying the authenticity of transactions.

We will explore how IFSC codes serve as identifiers for bank branches and their role in facilitating electronic fund transfers. The code helps in distinguishing between different bank branches, making it an essential component for secure banking transactions.

Role of the Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) plays a pivotal role in assigning and regulating IFSC codes across the country’s banking network. The RBI uses IFSC codes to monitor and track banking transactions, thereby preventing errors and fraud.

The RBI is also responsible for maintaining a centralized database of all IFSC codes, ensuring their accuracy and updating them as necessary. This oversight contributes significantly to the stability and integrity of India’s financial system.

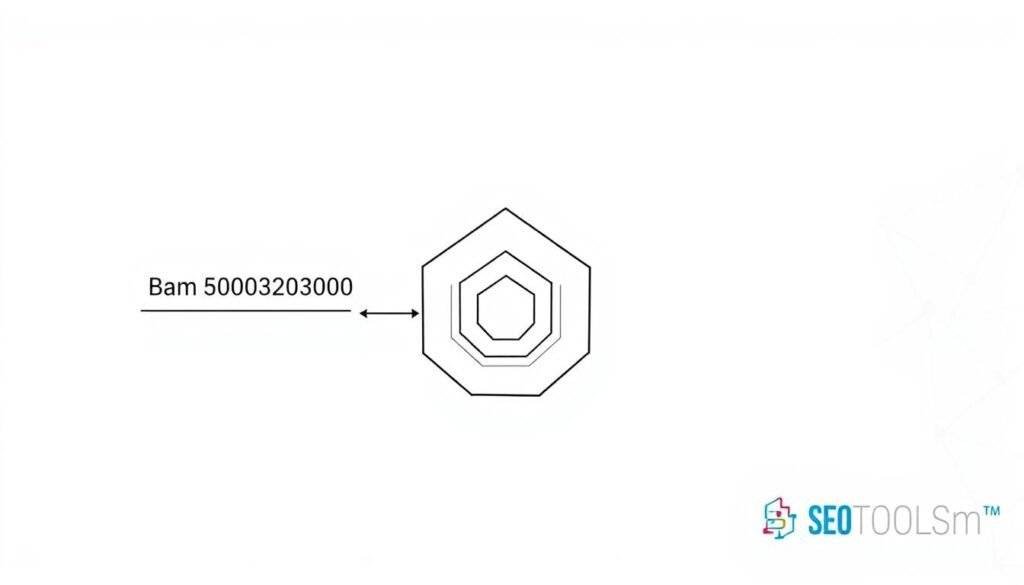

Understanding the Structure of Bank IFSC Codes

The structure of an IFSC code is designed to identify bank branches accurately. An IFSC code is an 11-character alphanumeric code that is essential for electronic fund transfers in India.

The 11-Digit Alphanumeric Format

The IFSC code is not just a random combination of characters; it follows a specific format that makes it unique and useful for banking transactions. The IFSC code is an 11-character code that includes both letters and numbers.

The first four characters are alphabetic and represent the bank’s name. For example, HDFC, ICIC, and SBIN represent HDFC Bank, ICICI Bank, and State Bank of India, respectively.

The fifth character is always zero (0), which was originally reserved for future use by the RBI. The last six characters are numeric and identify the specific branch of the bank, making each branch’s code unique even within the same bank.

What Each Part of the Code Represents

| Characters | Description |

|---|---|

| First Four Characters | Bank Code (Alphabetic) |

| Fifth Character | Reserved for Future Use (Always 0) |

| Last Six Characters | Branch Code (Numeric) |

For instance, if we consider an IFSC code like HDFC0001234, here’s what it represents: HDFC is the bank code indicating it’s HDFC Bank, the fifth character is 0, and 001234 is the branch code identifying a specific branch of HDFC Bank.

This structured format helps in the accurate routing of funds during electronic transfers. It also makes IFSC codes easy to remember and verify, reducing the chances of errors during transactions.

Why Bank IFSC Codes Are Essential for Transactions

Bank IFSC codes play a pivotal role in ensuring the efficiency and security of electronic fund transfers in India. We will explore the reasons behind their importance in the banking system.

Electronic Fund Transfers (NEFT, RTGS, IMPS)

The IFSC code is crucial for conducting electronic fund transfers through various channels such as NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service). Without the IFSC code, NEFT transactions cannot be processed. Individuals need to provide the IFSC code when transferring money through these options, as it helps identify the specific bank branch involved in a transaction.

We rely on IFSC codes to route funds to the correct bank branch and account, making them mandatory for various electronic payment systems.

Security and Accuracy in Banking Transactions

IFSC codes are essential for ensuring the security and accuracy of online banking transactions. By providing a unique identifier for each bank branch, IFSC codes help minimize errors in fund transfers and ensure that the funds are transferred to the intended recipient’s account.

The banking system uses IFSC codes to track and verify transactions, adding an additional layer of security. This precision in identifying the destination bank branch reduces the risk of funds being sent to incorrect accounts.

How to Find Your Bank IFSC Code

Locating your bank’s IFSC code is a straightforward process that can be completed in several ways. The IFSC code is a crucial piece of information required for electronic fund transfers, and having it readily available can simplify your banking transactions.

Checking Your Cheque Book or Passbook

One of the simplest methods to find your bank’s IFSC code is by referring to your cheque book or passbook. The IFSC code is typically printed at the top left corner of your cheque leaf, along with the branch address. Similarly, the front sheet of your passbook contains your account details and branch information, including the IFSC code. Always verify that the code is 11 digits long and alphanumeric.

Using Your Bank’s Official Website

Almost all banks provide a ‘Branch Locator’ or ‘IFSC Finder’ tool on their official websites. To find your IFSC code using this method, visit your bank’s website, navigate to the Branch Locator tool, and enter your branch name or location. The tool will then provide you with the IFSC code and other relevant details. This method is particularly useful if you have lost your cheque book or passbook.

Using the RBI Website

The Reserve Bank of India (RBI) maintains a comprehensive database of IFSC codes on its official website. To find your IFSC code, visit the RBI website, go to the ‘IFSC codes’ section, select your bank from the drop-down menu, and enter your branch name. The website will then display the IFSC code for your branch. This method is reliable and provides accurate information.

Other Methods to Locate Your IFSC Code

Apart from the methods mentioned above, there are other ways to find your IFSC code. You can check your bank statements or account opening forms, as the IFSC code is often printed on these documents. Additionally, many mobile banking apps display the IFSC code in the account details section. If you’re still unable to find it, you can contact your bank’s customer service or visit your branch in person to obtain the IFSC code. Here are some key points to consider:

- Verify the IFSC code before using it for transactions to avoid errors.

- If you’ve recently changed branches, ensure you update your IFSC code accordingly.

- Keep a record of your IFSC code for future reference.

Popular Indian Banks and Their IFSC Codes

The IFSC codes of prominent banks in India follow a specific pattern that identifies the bank and branch. Understanding these codes is essential for efficient banking transactions.

State Bank of India (SBI) IFSC Codes

State Bank of India (SBI) IFSC codes typically begin with “SBIN” followed by a zero and six digits that identify the specific branch. For example, the IFSC code for SBI’s Commercial Branch in New Delhi is SBIN0018173.

HDFC Bank IFSC Codes

HDFC Bank IFSC codes start with “HDFC” and adhere to the standard 11-digit alphanumeric format. An example is HDFC0000003 for the K G Marg branch in New Delhi.

ICICI Bank IFSC Codes

ICICI Bank IFSC codes begin with “ICIC” and follow the same structure. For instance, ICIC0001359 is the IFSC code for the Delhi – Barakhamba branch.

Punjab National Bank IFSC Codes

Punjab National Bank IFSC codes start with “PUNB” followed by the branch identifier. The CPPC, Ludhiana branch has the IFSC code PUNB0746700.

Axis Bank IFSC Codes

Axis Bank IFSC codes begin with “UTIB,” reflecting the bank’s earlier name, UTI Bank. An example is UTIB0000007 for the New Delhi branch.

Here’s a summary of the IFSC codes for these major banks:

| Bank Name | Branch Name | IFSC Code | Address |

|---|---|---|---|

| State Bank of India | Commercial Branch New Delhi | SBIN0018173 | 2ND FLOOR, NEW DELHI MAIN BRANCH 11 PARLIAMENT STREET NEW DELHI |

| HDFC Bank | K G MARG | HDFC0000003 | 209 – 214 KAILASH BUILDING 26 KASTURBA GANDHI MARG NEW DELHI DELHI |

| ICICI Bank | Delhi – Barakhamba | ICIC0001359 | G-4,19, Arunachal Building, Barakhamba Road, New Delhi |

| Punjab National Bank | CPPC,LUDHIANA | PUNB0746700 | 5,FEROZEPUR ROAD ,LUDHIANA |

| Axis Bank | New Delhi | UTIB0000007 | STATESMAN HOUSE, 148, BARAKHAMBA ROAD |

Understanding the IFSC codes of these major banks helps in identifying the bank and branch, facilitating smoother transactions.

Common Issues with Bank IFSC Codes

Accurate IFSC codes are vital for secure and efficient banking transactions, and errors can have significant consequences. We encounter several common problems related to IFSC codes in everyday banking transactions.

What Happens If You Enter an Incorrect IFSC Code?

Entering an incorrect IFSC code during an online transfer can lead to the funds being credited back to your account. This occurs when the IFSC code entered does not match the bank’s database for the intended recipient. The process for returning funds can vary depending on the banks involved and the type of transfer.

It’s essential to understand that IFSC codes are branch-specific, not account-specific. This means that if you transfer your account to a different branch, your IFSC code will change. For instance, changing your branch from Lower Parel to Andheri (West) will result in a new IFSC code, although your account number remains the same.

IFSC Code Changes After Branch Transfer or Merger

Bank mergers and acquisitions can also affect IFSC codes. When a bank branch closes or merges with another, the IFSC code may change, requiring customers to update their banking details with their bank in India. It’s crucial to stay informed about such changes to avoid transaction failures, as advised by the Reserve Bank of India.

To manage IFSC code-related issues effectively, it’s helpful to keep track of frequently used codes and verify them before transactions. Additionally, understanding that IFSC codes cannot be derived from account numbers can help avoid confusion.

| Issue | Description | Resolution |

|---|---|---|

| Incorrect IFSC Code | Funds are not transferred to the intended recipient due to an incorrect IFSC code. | Funds are typically credited back to the sender’s account. |

| Branch Transfer | IFSC code changes when an account is transferred to a different branch. | Update the new IFSC code with the bank and relevant parties. |

| Bank Merger/Acquisition | IFSC code may change due to bank restructuring. | Customers should update their records with the new IFSC code. |

By being aware of these common issues and taking steps to manage IFSC codes effectively, we can minimize the risk of transaction failures and ensure smoother banking experiences, as guided by the Reserve Bank of India, and enhance our interactions with bank India.

IFSC Codes vs. Other Banking Codes

Understanding the nuances between various banking codes is crucial for seamless financial transactions. In the Indian banking system, codes like IFSC, MICR, and SWIFT play vital roles in different types of transactions.

IFSC vs. MICR Codes

IFSC (Indian Financial System Code) and MICR (Magnetic Ink Character Recognition) are both used in banking, but they serve different purposes. While IFSC codes facilitate electronic fund transfers between bank accounts, MICR codes are primarily used for cheque clearing processes.

The structure of these codes also differs significantly. An IFSC code is an 11-digit alphanumeric code unique to each bank branch, whereas a MICR code is typically 9 digits, printed on cheques using magnetic ink to facilitate quick processing.

- IFSC Code: Used for electronic fund transfers like NEFT, RTGS, and IMPS.

- MICR Code: Used for cheque clearing and processing.

IFSC vs. SWIFT Codes for International Transfers

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes are used for international money transfers, unlike IFSC codes which are specific to the Indian banking system for domestic transactions. A SWIFT code can range from 8 to 11 characters and includes identifiers for the bank, country, and branch.

For international transactions involving Indian banks, both IFSC and SWIFT codes might be required. For instance, to receive an international transfer, the sender needs the SWIFT code of the bank, while the IFSC code, regulated by the reserve bank india, is necessary for the funds to be credited to the correct account.

- SWIFT Code: Essential for international money transfers, identifying the bank, country, and branch.

- IFSC Code: Crucial for domestic electronic fund transfers within India.

Understanding the differences between these codes helps in using them correctly for various banking transactions, ensuring that funds are transferred accurately and efficiently.

Tips for Using Bank IFSC Codes Effectively

The accuracy of Bank IFSC Codes is paramount for secure and efficient financial transactions. To maximize their utility, it’s essential to understand how to use them effectively.

Verifying IFSC Codes Before Transactions

Verifying the IFSC code before initiating a fund transfer is crucial to avoid delays and potential loss of funds. We recommend cross-referencing the IFSC code with the official bank website or contacting the recipient directly to confirm its accuracy. This simple step can significantly reduce the risk of transaction errors.

For instance, a wrong IFSC code can lead to the transfer of funds to an incorrect account, causing inconvenience and potential financial loss. Therefore, it’s advisable to double-check the IFSC code using multiple sources.

Keeping Track of Frequently Used IFSC Codes

Maintaining a record of frequently used IFSC codes can streamline regular transactions and help you address any issues quickly. We suggest keeping a secure digital or physical record of these codes to avoid the hassle of searching for them every time a transaction is made, saving you valuable time.

Organizing IFSC codes for different payees in your online banking profiles or personal records can also enhance the efficiency of transactions within the indian financial system. Periodically verifying saved IFSC codes, especially after bank mergers or branch relocations, is also a good practice.

Here’s an example of how you can organize your IFSC codes:

| Payee Name | Bank Name | IFSC Code |

|---|---|---|

| John Doe | SBI | SBIN0001234 |

| Jane Smith | HDFC | HDFC0005678 |

| ABC Corporation | ICICI | ICIC0009012 |

By following these tips, you can ensure that your banking transactions are secure, efficient, and error-free. Setting up beneficiaries in your online banking account with verified IFSC codes can make recurring transfers easier and more convenient.

Conclusion

As we conclude our exploration of Bank IFSC Codes, it’s clear that these unique identifiers play a vital role in India’s banking system. Throughout this article, we’ve discussed the definition and importance of IFSC codes in facilitating electronic fund transfers.

We’ve highlighted the various methods to find your bank’s IFSC code, from checking your cheque book to using online resources. It’s crucial to use the correct IFSC code to avoid transaction failures and delays in fund transfers. Additionally, we’ve distinguished between IFSC codes and other banking codes like MICR and SWIFT.

To ensure convenient and secure banking, we recommend keeping frequently used IFSC codes readily accessible. Staying informed about any changes to IFSC codes, especially after bank mergers or branch relocations, can prevent future transaction issues. As India’s banking landscape continues to digitize, the importance of IFSC codes will only continue to grow, making it essential to understand and use them effectively for smooth banking transactions.

FAQ

What is the purpose of an IFSC code in our banking system?

We use the IFSC code to facilitate electronic fund transfers, such as NEFT, RTGS, and IMPS, ensuring that the money reaches the correct branch of the recipient’s financial institution.

How do we find the IFSC code for our bank account?

We can find the IFSC code by checking our cheque book or passbook, visiting our bank’s official website, or using the Reserve Bank of India’s website to search for the code.

What happens if we enter an incorrect IFSC code during a transaction?

If we enter an incorrect IFSC code for our bank branch, the transaction may be delayed or even fail, potentially resulting in the funds being credited to the wrong account or being returned to our account.

Are IFSC codes the same for all branches of a particular bank?

No, each branch of a bank has a unique IFSC code, which is why we need to ensure that we’re using the correct code for the specific branch where our account is held.

Can we use the same IFSC code for international transactions?

No, for international transactions, we need to use the SWIFT code, which is a different code that enables cross-border money transfers.

How do we verify the IFSC code before making a transaction?

We can verify the IFSC code by checking it on our bank’s official website, the RBI website, or by contacting our bank’s customer care to ensure that we’re using the correct code.

What is the difference between IFSC and MICR codes?

While both codes are used for banking transactions in the indian financial system, the IFSC system code is used for electronic fund transfers, whereas the MICR code is used for cheque clearing and processing.